“I Have Nothing but High Hopes”: Retailers on the Surprisingly, Quietly, Maybe Positive First Half for Comic Shops

Whenever the subject of the direct market’s health comes up, the conversation tends to focus on extremes. The moment is always an epic disaster or huge success, with little attention paid to anything in-between those poles. That makes for scintillating conversations and thinkpieces while inspiring a sea of YouTube videos that declare this point to be either the best or the worst, depending on where things are. But the reality is that the state of comics retail is rarely ever just one thing.

But why should that be a surprise? After all, the direct market is the side of the comics industry defined by a couple thousand unique and independent comic shops, each with a customer base that is equally singular. Comics retail isn’t a monolith, no matter how some may act. Lean times for one shop could be a bonanza for another, and everything in-between. It’s just the way it works.

2024 has been no different, at least amongst the shops I’ve been talking to. Everyone’s experiences have been wholly their own, with distinctive plusses and minuses in each store, even if there is overlap. But if there’s one unifying factor, it’s that most — not all, but most — are feeling a little better about where things are after a troubling year or two, and that was true whether the shop was up on the year or down.

“2024 has been great!” said Erik C. Jones, the manager of Winchester, Virginia’s Four Color Fantasies. “We’re signing up new subscribers every week, walk-ins are steady, both are trying new books and picking up trades. It’s a great time.”

“So far, we’re down 4.25% from the same point — January to May — in 2023, and 2023 was down just over 4% from 2022, so it looks like the attrition continues,” explained Patrick Brower, the co-owner of Chicago’s Challengers Comics + Conversation. “But I’ll tell you this…it doesn’t feel down.”

That last point is crucial, as it’s an underlying sentiment others shared. When Brower says, “it doesn’t feel down,” he means that the path to these results has been much more encouraging — especially with things trending upwards in recent months at Challengers after a slow start. In this mid-year check-in with comic shops, 1 the highs were a little higher and more frequent while the lows didn’t come with quite as much pain attached. And that’s a good thing.

That doesn’t mean that was the case for all comic shops. There have been high visibility closures this year, albeit ones often connected to economic and real estate concerns as much as anything comic related. On top of that, ComicsPRO’s 2 survey of the direct market from January revealed that many were still facing significant headwinds. There are undeniably challenges in this space. But after a perilous stretch, it was heartening to see the tides turning ever so slightly towards a more encouraging present for the shops I talked to, one that lacks some of the bad feelings retailers were carrying with them in recent check-ins. While outsiders may revel in the explosive highs and lows of the direct market’s post-pandemic era, I suspect many retailers could go for the more tranquil vibes these shops are exuding.

The easiest way to express how different this year has been so far is in how many shops were either comfortably up or effectively level with where they were the year before. More than half the retailers I talked to fit into one of those two camps — and sometimes with great enthusiasm.

That enthusiasm can be predictable. It’s what I expect from Steve Anderson of Maryland and Virginia’s comic shop chain Third Eye Comics. Anderson is the retailer equivalent of a ray of sunshine. He’s also incredibly successful, having been on a heater for as long as I’ve known him with new locations opening on the regular. He told me that 2024 has been a “great year,” with comics and graphic novels “all trending up.”

That’s how Anderson rolls, though. Not everyone has his circumstances. Jen King of Shenandoah, Texas’ Space Cadets Collection Collection certainly didn’t. She went into 2024 in a much more tenuous place. Her shop moved into a local retail center this year, something she hoped would make a difference after a difficult stretch. It was a calculated risk, and one that paid off, as Space Cadets “definitely feels like” it is moving in the right direction, per King. The new location has given the shop “a true Wednesday again” and a return to pre-pandemic numbers for its Saturdays. That’s been a boon for her store overall.

Aaron Trites from San Diego’s Now or Never Comics and Dan Wallace from Tulsa, Oklahoma’s Impulse Creations were even more enthusiastic. The former is up 15% in sales year-to-date, with customers spending more “in almost every category,” while the latter has continued a “multi-year period of growth” with a 14% boost so far. They’re on the high end of results amongst shops I talked to.

Two retailers reported that they were level-ish so far. Bruno Batista from Dublin’s Big Bang Comics emphasized that they “are doing fine!”, while Christina Merkler from the online comics giants Discount Comic Book Service (DCBS) and InStockTrades saw flat sales in her single-issues focused business and an uptick in the trades and graphic novel-centric one. In a wildly unpredictable market, both will take it.

Only four have seen decreased sales so far. That was Challengers and California’s Current Comics, 3 Cape & Cowl Comics, 4 and Comics Conspiracy. 5 All three West Coast retailers largely echoed Brower’s “This is fine” attitude about the first half’s results, even if each offered their own flavor of it.

Current Comics’ Travis Pratt said his shops saw a dip, but with comics and graphic novels both up and the store gaining new subscribers of late, he’s feeling “excited for the rest of the year.” Eitan Manhoff of Cape & Cowl Comics was genuinely confused by his experiences. He’s down overall with comic sales rising by 10% and graphic novels falling by 20%, which is a bit anomalous relative to recent trends. Overall, though, enthusiasm seems to be there in the shop and things are trending in the right direction. Lastly, Ryan Higgins of Comics Conspiracy has seen a return to around 2019’s numbers, something he described as “sustainable,” although he admitted they “obviously miss those extra sales.”

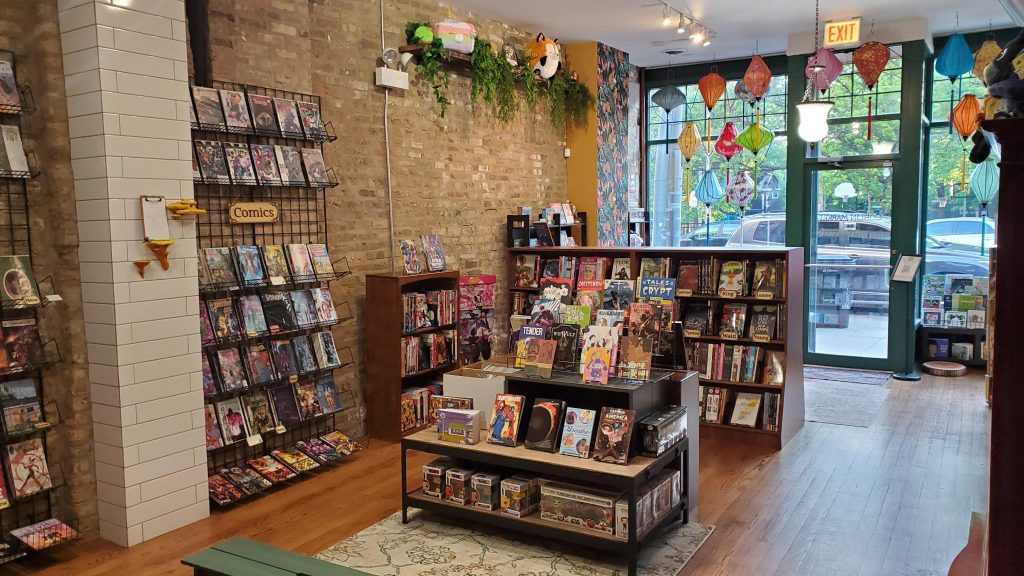

The last shop wasn’t up, down, or even level on the year. That’s because it’s a new one altogether. It’s Chicago’s Goblin Market Manga, Games & Curiosities, the city’s “first dedicated manga store” per its co-owner Don Alsafi. 6 It opened in October 2023 with a “sideline in comics.” They zigged while everyone else zagged in their comic shop-heavy city, focusing on manga and a comics and graphic novels section that “is far more curated than expansive.” The only titles they stock on the shelves are “those that we particularly believe in,” per Alsafi, a move that makes sense given the plethora of comics in the market today. While it’s too soon to make any year-over-year comparisons, I’ve heard nothing but good things about the shop — and its formula seems to be working.

One commonality most shared was a reported uptick in foot traffic, with Wednesdays being particularly busy. Even Challengers, one of the shops that was down, has been roughly level on that front. Having customers is essential to making sales, and even those that aren’t converting as many as they’d like are getting plenty of opportunities to do so.

It isn’t all roses, of course. Big Bang saw a “noticeable” decline in active pull lists this year, as they currently have 15% fewer single-issue subscribers than last year according to Batista. But the disappearance of those regulars has largely been offset by “new customers ordering other things like manga and graphic novels,” which the retailer will happily take. That matches one of this check-in’s main themes: many of the negatives have positives balancing them out, at least to some degree.

While quantifiable metrics like sales and foot traffic are key, some qualitative aspects can be vital to understanding how things are going for these shops. Maybe the most important, and arguably most predictive, is customer sentiment. One of the consistent points I heard from retailers in previous editions of this feature was that there was a growing number of customers who were just going through the motions. They were buying, but they weren’t doing so with enthusiasm, which could have been a portend for even tougher times.

That isn’t as true as it was. Shops have seen increased excitement and optimism from customers. As Higgins said, “The vibes in the shop are directly the opposite of the vibes online.” There’s a positive energy in customer interactions after those feelings had waned of late. That’s not universally true, of course. Batista said that some customers have soured on the current slate of single-issue comics. But as Jones knows all too well, that’s just part of the endless cycle of being a comic fan.

“You’re always going to have the people who complain that comics are too expensive now and the stories aren’t as good as they used to be,” Jones said. “But those people complained about the same things when I worked here 24 years ago in high school.

“The majority of people who are reading comics read and love what they like.”

2024 has made that a bit easier on everyone. That’s because it’s offered retailers something they’ve desperately wanted and needed in recent years: hits. The titles that were meant to be big have proved to be just that, and a few buzzy books can quickly make the bad feelings go away.

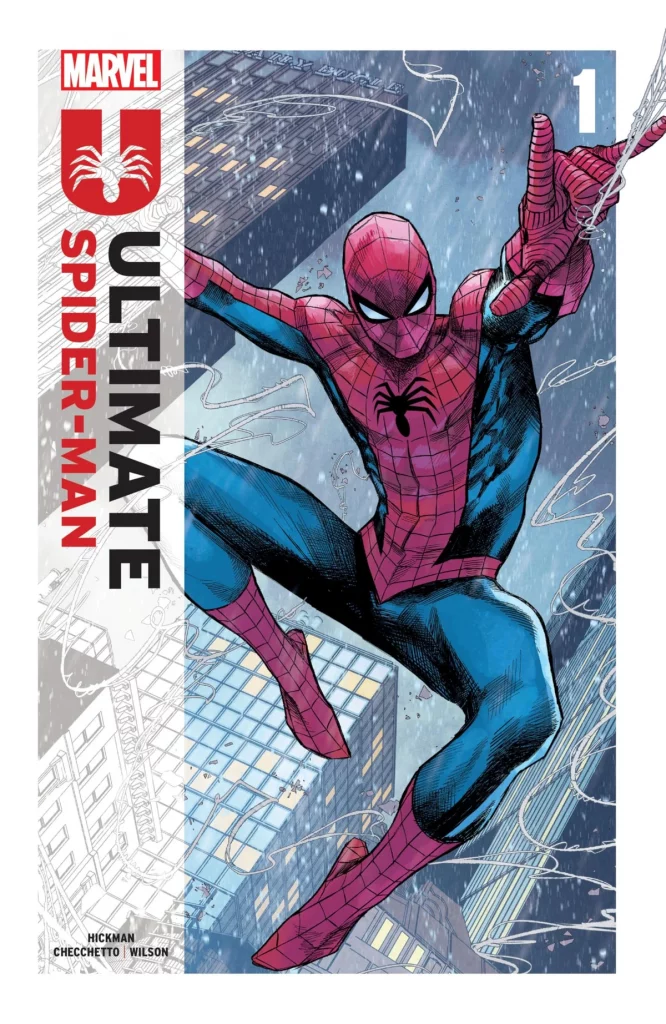

Far and away the biggest success has been Ultimate Spider-Man. It was described by retailers as “a total juggernaut” and “a certified hit,” with Alsafi’s manga-centric shop even struggling “to find a ceiling” for the series and its sales. Trites said it’s outselling its main universe counterpart Amazing Spider-Man three to one at Now or Never, which is a staggering number.

If Ultimate Spider-Man is 1a for shops, then Transformers is 1b. Batista described that title as USM’s “only real sales competition,” with the two running “neck and neck” at the top of Big Bang’s best sellers list. The incredible thing about Transformers and the Energon Universe it belongs to, though, is how much they have outperformed previous iterations of those comics. Both Brower and Manhoff said their numbers were low for Transformers and G.I. Joe before they switched publishers, with those titles only hitting “single digit sales” at Challengers. Now? They’re giant hits.

“We’ve gone from a store that was pretty much special order only on G.I. Joe and Transformers books to one that orders hundreds every month,” Manhoff said. “It’s wild!”

The trend that I’ve dubbed micro-lines, or self-contained lines of a few associated titles, has been a big driver this year. That’s especially true for Ultimate and the Energon Universe, but even things like the Image imprint Ghost Machine have connected. While the headliners in USM and Transformers tower over the rest, related releases have benefited from the heat those have generated. Even something like Void Rivals, Robert Kirkman and Lorenzo De Felici’s series that launched the Energon Universe but lacked the brand recognition of its peers, has done well. Higgins said “it’s outselling just about every other original Image book right now not called Saga or Ghost Machine” at Comics Conspiracy.

Trites believes one reason these have popped is that “there’s a lot of appeal to a manageable closed loop, especially when the quality is high.” These micro-lines are easily accessible for both new and old readers. Ultimate’s four titles can be a lot more palatable than the dozens of comics Marvel’s regular line has to offer. More than that, the success they have can be “contagious,” as Wallace put it. The energy surrounding them has had an area of effect — both within their lines and beyond.

There’s another commonality between those, of course. As Merkler put it, “What we have been seeing over the last couple of years is an increase in anything that is nostalgic.” Whether it’s the Energon Universe, the return of Ultimate, the endless success of the Teenage Mutant Ninja Turtles, 7 or Dynamite’s licensed titles like Thundercats or Space Ghost, it’s been a big year for yesteryear.

It’d be easy to look at that cynically, as both comics and the wider world of entertainment have leaned heavily on repackaging and recycling what used to be popular of late. But those feelings are mitigated by the fact that most of these are also good comics. That fits an ongoing shift that Anderson has been touting. He emphasized that “content is returning to being king.” What most consistently sells at Third Eye is quality, because “people want great stories” above all.

The other repeated winner on the single-issue front is a publisher that pushes the boundaries of what we mean when we talk about that format. Multiple shops specifically cited DSTLRY as a hit. Trites said the publisher’s “releases have outperformed our expectations,” while Manhoff added that they “earned brand loyalty pretty much overnight.” The quality and creative teams were the big draws, both of which helped shops overcome customer concerns about the publisher’s price points and oversized dimensions.

Strangely, it’s been an uneven year on the graphic novels and collections front after a multi-year surge. While some, like Merkler and King, continue to see growth — particularly on the kids’ graphic novels side for King, who said she’s struggled “to keep up with demand” — others have unexpectedly dipped on that front. Brower shared why that may be true, saying that “there has been considerably less coming out than usual.” The hope is a beefier release list with some real headliners could lead to an uptick in the second half.

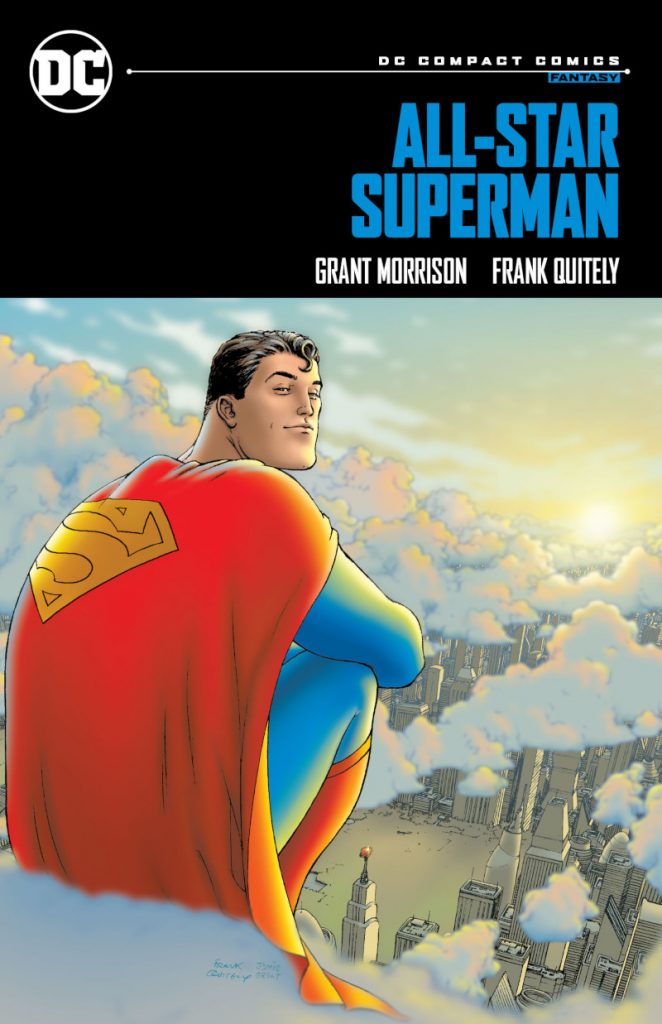

If there’s one hit on the collections front, though, it’s how publishers are repackaging old material in appealing new formats. DC’s Compact Comics line leads the way. Wallace said it “looks to be a hit so far.” He wasn’t the only one that praised the publisher’s digest-sized editions that collect mostly complete and classic stories for $9.99. Batista said these value-focused releases have “surpassed our expectations and then some.”

“This industry can and should support all sorts of price points, and it’s about time we start seeing more of that,” Batista said.

It’s been a growing trend, and one that DC isn’t alone in. The Invincible Compendiums were another notable hit, and shops were enthusiastic about publishers like Image announcing even more of those phone book-like collections. 8 The belief is there’s a lot of potential there, especially for newer readers.

Speaking of newer readers, something fundamentally designed to appeal to those folks earned repeated mentions. After a bit of a downturn of late, several said that this year’s Free Comic Book Day was a massive success. Manhoff viewed it as a turning point for Cape & Cowl’s year. They had a slow start before “Free Comic Book Day came in to save the day,” with the shop “rolling along at a nice clip since then.” Trites even shared that FCBD “set a new (single day) record for most” customers at Now or Never.

While that wasn’t what everyone saw, 2024’s edition was largely viewed as a return to pre-pandemic form for FCBD, one that paid real dividends for participating shops.

If there’s one indicator that best reflects the tenuously resurgent vibes 2024 has had, it’s how the downs don’t feel quite as down this time. Most notably, there were some challenges that shops were split on — if not leaning mostly towards the positive. A mixed bag might not sound like much of a win, but it’s only natural for some to do well with certain efforts and others to not. The real problems arise when something is down for everyone, as has often been the case in recent years.

One example of this are the Big Two’s events. DC and Marvel seem to be putting a little more emphasis on those tentpoles this year, with Absolute Power and Blood Hunt earning a major push. Unfortunately, they haven’t worked at all at Big Bang. Batista said the shop’s “customers seem to be very against them,” with Blood Hunt’s sales matching low level X-Men titles and Absolute Power inspiring few pre-orders.

And yet, most retailers ranged from slightly positive to downright effusive about these blockbusters, like Manhoff, who said “Big Two events have been a pleasant surprise so far this summer.” Merkler believes that customers were eager for one of these crossovers to hit and the results at DCBS have matched that, with both Merkler and Higgins sharing that Absolute Power is one of their top sellers.

That’s a bit atypical, as more succeeded with Blood Hunt than Absolute Power. Several emphasized that the Red Band editions of Marvel’s event have actually proved to be crucial drivers for them, even if several weren’t fans of the idea. Both are working, though, albeit at lower than peak event levels. Even Batista was pleased to discover that Absolute Power eventually connected with readers when it launched, although it took the shop eating some of its cover price 9 to get there.

Another example of the year’s high variance results is the transition the X-Men line is going through. For some, the Krakoa Era was a hit, one that mostly had solid sales throughout its run, which might be why pre-orders for the new From the Ashes era have been so low. Batista went as far to say that Big Bang’s numbers for that relaunch were looking “abysmal.” 10 Conversely, others said Krakoa had run its course and that readers were ready for something new. Manhoff said that X-Men #1 has already doubled the most recent top-selling Krakoa title’s subscriber numbers, with Brower adding that customer “excitement feels higher than it has in a minute as far as X-Books are concerned.” The response was all over the place.

And that might be a good thing, if only because that means there weren’t as many universal struggles. Many of the issues from the past year or two remain, as Jones reported that customers are still sampling first issues rather than staying for the long-haul, several bristled at how the emphasis on finite series is giving readers too many jumping off points, and Batista said there are just too many titles that generate “zero reaction” amongst customers. But few were constant problems in the way they often are.

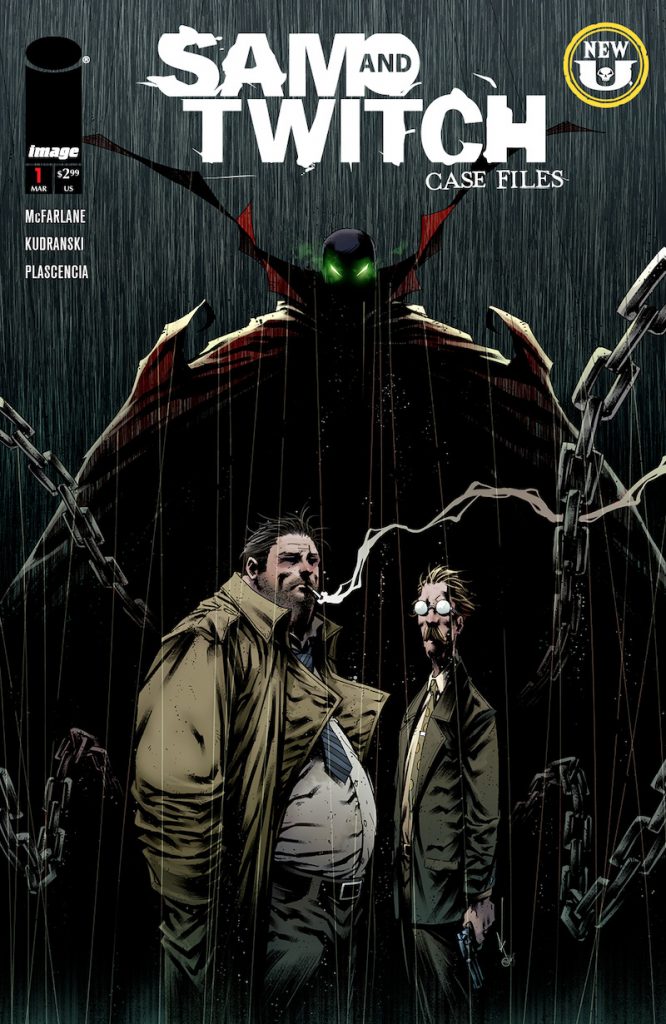

What Batista mentioned borders on one of the most frequent complaints, though. That’s the idea that there are still too many comics, many of which have no clear audience. Fewer customers are “experimenting and testing new titles,” Higgins said, resulting in a bevy of books that just do not move. Trites pointed to the Spawn Universe titles as a good example of this. When the first wave of those books launched, most came in around 50% of the main Spawn title’s sales in his shop. That was manageable. What came next wasn’t. The retailer said, “The latest batch launched at less than 10% of our Spawn sales.”

“It’s just too much,” Trites added.

“Too much” is a key phrase in general. Some, but most notably Jones, emphasized that there are too many variant covers given how the collector market has deteriorated. It doesn’t help when publishers overload certain weeks with major releases and follow those up with comparatively quiet slates, as Merkler told me. The unbalanced schedule can limit the ceiling and floor of entire weeks. Combine all that together and you can see why some shops believe customers can feel overwhelmed at times.

“My impression is that our customers are extremely satisfied with the quality of the comics they’re reading, but there’s a general consensus that there’s just way too much to keep up with,” Manhoff said.

This is a bigger challenge for smaller publishers, for the most part. They’re almost always going to get the short end of the stick when single-issue customers make hard choices. But the Big Two have their own issues. DC earned several demerits, as Anderson said its line is feeling “a bit stale” overall. Surprisingly, both Brower and Pratt noted that DC’s problem is that they’re publishing too few comics, with some essentials being conspicuously absent. The Big Two’s difficulties aren’t just on the single-issue front, either. Brower said Challengers simply isn’t ordering “newer superhero collections from Marvel and DC anymore.” There’s little demand and the constant relaunches have killed the shelf lives of these releases, meaning they struggle in the short and long-term. Those are different formats, but it’s all connected.

In general, retailers wish they had more support from their partners on the publishing side. Manhoff is dying for these houses to market their releases better, as it seems publishers expect shops to “run a mini free marketing firm for (their) products.” Anderson said his life would be easier with product data being delivered at faster speeds and with more accuracy. Pratt, but really everyone, wants the Big Two to only close orders for new issues after the previous one has released so they can have sales data to guide their decisions. Processes like those continue to be problems, and the biggest pain points in that vein range dramatically from shop to shop.

But the biggest challenge is outside of everyone’s control. Brower’s co-owner at Challengers, W. Dal Bush, hit the nail on the head when he said “the economy and inflation” are the main problems right now. Bush believes that people just don’t feel like “they have the disposable income to treat themselves to comic book entertainment,” and that has led to cutbacks on how much customers spend per transaction — if they don’t disappear altogether.

Those economic issues cut both ways, too, with shops feeling the burn on the other side. Higgins said that retail rent prices, utility and insurance rates, and supplies and shipping costs have made the job “tougher and tougher,” especially given the comparatively low prices of the products they sell. Costs being up for customers and shops means that retailers have to be even sharper in their approach than ever before.

“Staffing is so much more expensive. Overall costs are up. And our prices are largely fixed,” King said. “It means being smarter about having items that sell well and generate income to cover those increased costs.”

It’s a tough time for anyone in the retail space, let alone one as niche as comic shops. When things go bad, they can go bad quickly, especially if there isn’t adequate support from industry partners. The good news is those teammates might finally be doing what they can to help retailers find better solutions.

There are plenty of changes coming from publishers and beyond. DC shifted its new comic release date back to Wednesday, publishers have talked publicly about embracing (slightly) longer runs, and ComicsPRO’s major data project, The COMET Standard, 11 is in progress. That’s just a small selection of current and upcoming changes on that side of things, but shops appreciate the effort — even if they’re not sure what it all might mean yet.

“It’s a bit too early to tell,” Higgins said. “But it’s heading in the right direction.”

The irony, of course, is that many of these solutions are for problems created by those same partners. As Alsafi noted, DC going back to Wednesdays “is not exactly DC doing something great, but rather reversing a terrible decision…after four years,” 12 while publishers “committing to longer runs is a good first step” that reflects these partners “finally admitting that their usual focus on short-term spikes has caused massive harm to their long-term sales.” But the choice to remedy them is encouraging, if only because it’s action from partners often defined by inertia.

“None of these on their own will make or break things for us this year, but I’m glad to see moves that acknowledge that things aren’t perfect in the industry the way they are and that things could possibly be better,” Trites said.

That’s a feeling many shared, but some admitted that retailers will need to continue to evolve as well. Wallace described the constant change of the past few years as “a matter of perspective.” He’s elected to view the shifting landscape as an opportunity to “figure out how to make change work for us.” Jones agreed, saying, “good comic shops roll with the punches and adjust to what works for them and what doesn’t.” In this tumultuous period, it’s necessary to change on the fly, and shops are doing just that.

That’s especially important because it’s clear that the world won’t be returning to how things were, so everyone needs to act accordingly.

“Comic book retail will never go back to the way it was pre-pandemic, but we’ve also stopped looking back at that as the end-all, be-all,” Brower said. “(We) have to keep looking forward.”

How retailers are feeling about what’s ahead of them might be the single biggest difference of anything we’ve covered here. Shops wanted to be positive in previous editions. It just wasn’t always possible. When it was, those sentiments were almost always couched in uncertainty. That wasn’t the case this time. Most are feeling the good vibes.

“I think during your last check in I used the words ‘cautiously optimistic,’” Trites said. “Halfway through the year, you can mark me down as downright optimistic!”

“Comics are not going away. The medium is not going away. The industry may need to change, but how fast or how much depends quite a bit on forces often outside of retailers’ control,” Alsafi noted. “But, with all that said? We do feel hopeful for the state of the industry, and for better changes continuing to come.”

“Customer excitement is the highest we’ve seen in recent memory, the quality of what comics creators are producing is exceptional, and we keep seeing new things on the horizon every week that we expect to lead to further growth,” Wallace added. “Rather than feeling like an artificial bubble that could burst at any time, this feels like a very natural sales growth stemming from good comics that people want to read.

“I don’t see that stopping any time soon.”

Fear remains, of course. King said “it’s still scary” right now, and that’s true whether Space Cadets is on a hot streak after its move or not. It’s a time where she believes that “even $5 a week can make all the difference in keeping your favorite (shop) healthy.” Manhoff is concerned that this year’s battleground election could result in a “bumpy road” for retailers. But there’s more positivity than there has been in a while, and a belief that even better times could be coming — if everyone keeps pushing in that direction.

“Maybe I’ve been in it too long, but I have been hearing the doom and gloom for the last 10 years and I haven’t seen it yet,” Merkler said. “Three years ago, the direct market had its biggest year ever, and the last couple of years are just a standard market correction after the boom of the pandemic. We just need to focus on what we do best and continue to harness the passion we have for comics and take our industry to the next level.”

That’s good perspective, but it’s also important to be realistic about where things are. As Batista put it, comics retail is “always at a perilous stage.” That’s because shops aren’t selling essentials but entertainment, something “people complain there is too much of” already. Maybe that’s why the sentiment surrounding the direct market is always swinging wildly from one pole to the other. There’s a fine line between success and failure, one retailers are keenly aware of. And it’s a line they walk every day. As per usual, the shops I talked to are making the most of it.

“There are still amazing stories being told every week, genuine surprises and wonders. The creativity in comics is unmatched, both in scope and in scale, and it’s not stopping. I always have hope that things will get better,” Batista said. “Our entire industry sometimes feels like it’s a couple of corporate decisions away from extinction, but you know what?

“We’re still here.”

As per usual, this is more of a temperature check of how things are going for a selection of shops from around the direct market. It isn’t meant to be a definitive, representative look at how everyone is doing.↩

A trade organization for comic retailers.↩

They have two shops, with one being in Monterey and the other being in Salinas.↩

Which is in Oakland.↩

That’s in Sunnyvale.↩

Alsafi co-owns it with two partners in Ryvre Hardrick and Daniel Dziubinski.↩

Trites said the upcoming TMNT series will debut as his shop’s “most ordered book in the last five years.”↩

I’m keeping an eye on Saga’s digest editions as well.↩

They ran a promotion that discounted the prelude issue, Absolute Power: Ground Zero, by three Euro to generate interest. It worked. They went from three pre-orders to 65 copies sold and a massive uptick in subscribing customers. That’s not a giant hit, but it’s a nice gain, and one they hope will pay dividends throughout the event.↩

They’re going to deploy the same discounted cover price tactic they used on Absolute Power on this week’s X-Men #1.↩

Which, in the shortest possible explanation, is designed to standardize publisher metadata that goes into point-of-sale systems to make everything as consistent and predictable as possible.↩

Not everyone agrees with the idea that Tuesday releases were a bad idea. Wallace was a big fan of having a sales day just for DC.↩