Alpha and Omega Men: A Look at Trade Release Strategies in Today’s Comic Industry

Last week was a turbulent week for hardcore DC Comics fans. It had the high highs and low lows of a comic book plot all packed into the drama-filled business side of things for the publisher. You see, DC’s vaunted DC YOU endeavor has generated fiery passion amongst certain parts of its fan base, with books like Midnighter and Omega Men drawing in a very vocal audience in particular. But in one quick move, that fervor turned from a positive to a negative. DC canceled 8 books – including Omega Men – and felt the wrath of its audience, particularly on social media. Just search “Omega Men” on Twitter if you don’t believe me.

The audience was aghast. There were many complaints – “I thought you were giving these books 12 issues?” “What happened to supporting books for new readers?” – but one stood out the most: how could a book as unique as Omega Men be canceled before its trade release? It’s an interesting question, as even its most ardent of supporters admit Omega Men reads more like an Image or Vertigo title than a classic DC book. Should DC be looking at every title through the same lens in today’s increasingly niche industry? Especially when books of this type tend to perform better in trade?

The good news is the response to its cancelation brought the book back to life. Omega Men lives again, fulfilling the publisher’s promise of 12 issues for the title. If I was a cynical man, I’d throw out a conspiracy theory about how this feels like a publicity stunt to drum up sales, but I’m not. It’s a happy thing for both readers and the creative team.

But the collection question runs deep, still. Even without angels on its shoulder, could trade sales have saved Omega Men, especially given the heat behind it on social media? To be honest, probably not, and a big reason is how DC handles trades. Despite a legion of fans saying, “I was waiting for trade” on Twitter, DC’s typical trade release strategy likely will ensure that the amount of pre-orders the book sees dwindle even beyond the standard difference between those claiming they’ll pre-order and those who actually do. Just look at the timing of its release.

Omega Men’s first collection isn’t even going to be available for order until December, with the trade arriving in March. With the final issue in that collection arriving in November, my question is this: why wait so long? It’s a question many have asked before me, for sure, and not just about DC.

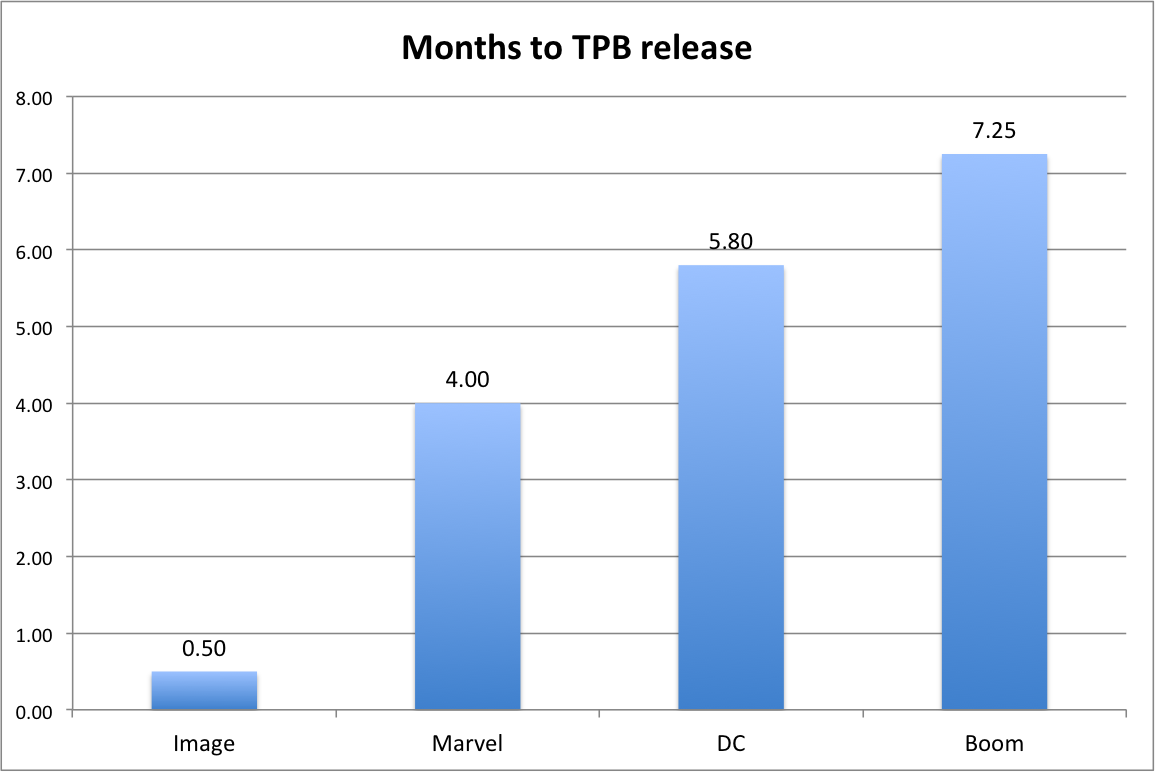

Beguiling trade release strategies are omnipresent in comics. As touched on in a previous longform, the way some publishers look at collections is with what one can only describe as a casual disregard. Or at least so I thought, before looking into it. After digging through data from a selection of previous and upcoming trade paperback releases, here’s what you’ll find for four of the biggest publishers in terms of the average span of time until trade release (numbers are months after the last issue of a collection, with the next month counting as zero).

Unsurprisingly, Image releases its trades at by far the quickest rate. Its books are seemingly adopting the vaunted “Saga schedule” across the board; with most books releasing the final issue of an arc and either releasing the trade the following month or a month later. Retailers I’ve spoken to cite trades as an increasingly large part of their mix, and many have shared with me off the record that slow trade releases can kill the momentum of books. Image seems to have been listening.

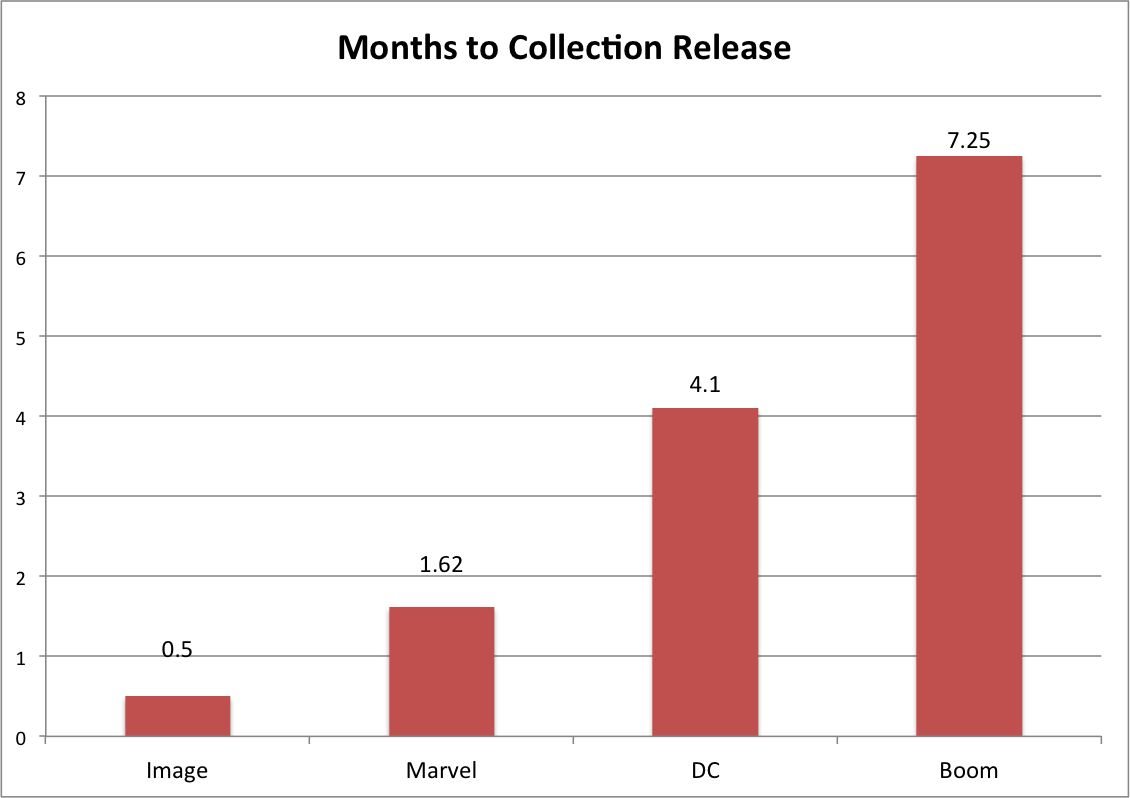

For the other three, there’s one other dataset to look at before fully judging them. While trade paperbacks are great low-cost options for collection readers (or trade waiters, as they’re often called), some publishers flight multiple collection types to release a higher priced hardcover product well before the trade release. Here’s the chart that includes all varieties of releases rather than just trades:

The biggest drop by far is at Marvel, whose time to release more than halves. In a way, that’s because Marvel appears to have two different trade release strategies (Marvel declined comment for the article).

1. Non-flagship books are released to trade no later than 3 months after the last issue in their collection, much of the time in comparable speeds to Image (see: Ms. Marvel Volumes being released the month after arc finales, typically)

2. Flagship books (i.e. Avengers or X-Men titles) see a hardcover release within 3 months with lower cost trades coming typically between 7 and 10 months later

As a strategy, that makes sense. Books looking to develop a fan base are given quicker trade releases, giving those on the fence of buying singles an option to buy a trade without missing out on the issues that follow. It’s a growth strategy. Meanwhile, titles with hardcore audiences – the Wednesday Warriors – see a tiered release schedule that likely ensures higher earnings on premium priced collections. Logical.

DC’s collections also dipped significantly, and they too have a tiered structure, but one that is much more all over the map. Their premium books like Justice League or Superman/Wonder Woman see an earlier hardcover release within six months of arc close and then a trade release around six to eight months after that. They’re a lot like Marvel in that regard, except slower paced – some titles don’t see a more affordable trade paperback for more than a year after the last issue of the collection.

Their lower tier books see trade releases first, but there isn’t a lot of rhyme or reason to how quickly they’re rolled out (DC never responded to an interview request for this piece). Here’s a look at the months to trade release for several current books as an example:

Their lower tier books see trade releases first, but there isn’t a lot of rhyme or reason to how quickly they’re rolled out (DC never responded to an interview request for this piece). Here’s a look at the months to trade release for several current books as an example:

Prez: 2 months

Black Canary: 3 months

Omega Men: 4 months

Gotham by Midnight: 5 months

Four different books, all aimed at different niches. Four different spans of time to the release of collections, which again are important for smaller, more unique books like these are. As has been shown time and time again, trade sales are paramount to the success of smaller books. It doesn’t matter who the publisher is. Just look at the success of Ms. Marvel, a book that saw higher initial orders for its third collection than its second. Trades – if leveraged correctly – can be audience builders for any book (although it is important for those books to sell enough to make it to trade and build interest, of course).

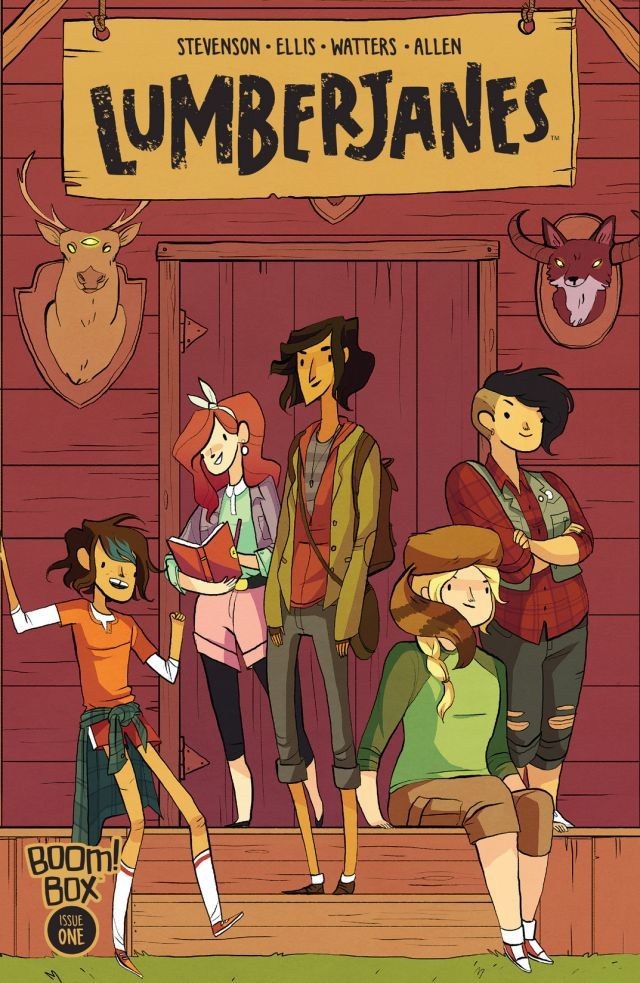

Coming up last in both charts is Boom! Studios. They’re a publisher that has been making significant strides in the past few years, as they’ve generated increasing acclaim for books like Wild’s End and Lumberjanes, some of which were certified comic hits. However, the path to collections is a curious one for most of their titles. Take these three books, for example:

The Woods Vol. 1: the next month after the arc ended

Lumberjanes Vol. 1: 9 months after the arc ended

Bravest Warriors Vol. 5: 14 months after the arc ended

The Woods and Bravest Warriors appear to be outliers, as the majority of their trade releases (from what I charted, at least) dropped 7 to 9 months after arc close. That fits in the average. Part of the fluctuation may be tied to the different houses of Boom!, as they have creator-owned titles, licensed comics, kids comics, and several imprints to release them all through. That’s enough to cause fluctuation.

Filip Sablik, Boom!’s President of Publishing and Marketing, explained how they plot out trade releases – not just span of time to release but also price points and other factors – in an email interview.

“It varies from title to title, because there’s no ‘one size fits all’ solution,” shared Sablik. “Part of that is by design; if you put everything into a predictable program, you risk retailers and fans tuning out. On some series we may wait up to a year after the first issue is released to debut the first collection to encourage sell-through on the single issues. This worked really effectively for Adventure Time where the audience was largely casual and skewed younger.”

“In other cases, like Deep State, we may rush a $9.99-priced first volume release in between issues 4 and 5 to encourage new readers to jump on board the series.”

Deep State, a creator-owned book from writer Justin Jordan and artist Ariela Kristantina, saw its first volume drop a month after the final issue of its arc. That is similar to what they did with James Tynion IV and Michael Dialynas’s creator-owned book The Woods, and it matches the general plan most publishers leverage on smaller, more niche-oriented books. Their plans for Adventure Time matched what Marvel and DC did with its top books, so in its own way, Boom! is just doing a variation of what the big guns do.

The one book that really confused retailers and myself in how it was released was the first volume of Lumberjanes, a book that is undoubtedly the hottest property Boom! has going. The book from Shannon Watters, Grace Ellis, Noelle Stevenson and Brooke Allen has been a sensation since day one, and its trade didn’t come out until 9 months after the close of the first “arc” of sorts. That’s bewildering, especially considering how much a book of that sort tends to rely on trades to build its audience. If Boom! was focused on making their trade release strategy unpredictable, they certainly accomplished that with this book. But Sablik had an explanation for that as well.

“We’ve found that waiting to start the collection program can often encourage sales of the single issues. We want to make sure retailers can take a position on our series and have confidence that we’re not going to undercut their ability to continue selling single-issue copies of popular series,” Sablik said. “There’s also a logistical concern, which involves the time it takes to print books overseas and properly sell-in a series into the book market, which happens six months before a collection is released.”

It’s hard to disagree with him too much given how the trade and the series has performed overall. Its collection has sold through at least five printings. Meanwhile, issue #17 had higher orders than issue #12 (the last issue before the first trade’s release) according to Comichron. That’s rare and, perhaps even more complimentary, Saga-esque. However, as comic fans – and human beings – it’s hard not to ask the age old question of “what if?” How would the book and trade have performed if it was handled more akin to what they did with The Woods or Deep State, two other creator-owned titles they publish?

It’s hard to disagree with him too much given how the trade and the series has performed overall. Its collection has sold through at least five printings. Meanwhile, issue #17 had higher orders than issue #12 (the last issue before the first trade’s release) according to Comichron. That’s rare and, perhaps even more complimentary, Saga-esque. However, as comic fans – and human beings – it’s hard not to ask the age old question of “what if?” How would the book and trade have performed if it was handled more akin to what they did with The Woods or Deep State, two other creator-owned titles they publish?

It’s hard to tell, but many retailers across the industry would have been happy if they had, especially considering two notable shops reported the first issue as their highest selling issue of the year. Boom! has found that everything has worked just fine – according to Sablik, Lumberjanes is hitting across all audiences with existing readers even choosing to double dip for the trade – and for them, it’s what they’ve found to work for a huge part of their mix: trade sales.

“Trade and original graphic novel sales are a critical piece of BOOM!’s overall publishing strategy, as I think they are for most top 10 comic publishers,” Sablik shared. And he’s not wrong. They are huge for publishers, and increasingly so. As trades and graphic novels take on greater importance at publishers, comic shops and bookstores, they’ve become not just supplements to a title’s sales, but in some cases the driving force behind their survival and the success of the creative team who makes them.

That is why the early dispatching of Omega Men mystified fans. Do we really even know what Omega Men is until its first trade is out? We might, if both retailer orders and a small look at in-shop sales are reflective of where the book is. Scott Tomlin of Comics Dungeon – a comic shop in Seattle – said he doesn’t believe these titles will sell better in trade. “It is very rare that any title sells better in the trade than in monthlies,” he shared. “The ones that do are also strong sellers on their own.”

Chris Thompson of Orbital Comics in London agreed with that sentiment, saying, “perhaps I’ll be proven wrong, but short runs of what was intended to be an ongoing series don’t do that well after the fact.”

Ralph DiBernardo of Jetpack Comics in Rochester, NH was asked whether or not the more unique books like Omega Men may sell better in trade, and he cited an Image title in his response. “You want to apply a Saga situation to a superhero universe. Overall, it’s tough to break that typical mold. I’d like to see that happen but am not convinced it will.”

All of this is why more outside-the-box thinking* with collections feels necessary. I’m not going to pretend to know the business nearly as well as the people who run these varying publishers. But as I wrote before, approaching comics in a different way could lead to major rewards. Just because there are tried and true methods for trade releases doesn’t mean there shouldn’t be flexibility within that structure. Sablik’s correct in that publishers can’t approach trade releases in a one size fits all way, and for books like Omega Men or Marvel’s Unbeatable Squirrel Girl, being aggressive with the timing of lower-priced trade paperbacks is likely the way to build an audience. In theory, they’d be loss leaders designed to build the monthly audience.

All of this is why more outside-the-box thinking* with collections feels necessary. I’m not going to pretend to know the business nearly as well as the people who run these varying publishers. But as I wrote before, approaching comics in a different way could lead to major rewards. Just because there are tried and true methods for trade releases doesn’t mean there shouldn’t be flexibility within that structure. Sablik’s correct in that publishers can’t approach trade releases in a one size fits all way, and for books like Omega Men or Marvel’s Unbeatable Squirrel Girl, being aggressive with the timing of lower-priced trade paperbacks is likely the way to build an audience. In theory, they’d be loss leaders designed to build the monthly audience.

One issue to consider with that method ties into what Sablik said about Lumberjanes. Could more aggressive trade scheduling – say, every publisher adopts the Saga schedule for trades – negatively impact the in-store sales of single issues? And maybe even encourage more trade waiting? It’s possible. The predictability of that method could, in theory, increase the amount of readers who justify waiting for trades rather than buying single issues. But that seems a small price to pay for potentially converting skeptics. Some just won’t read smaller titles monthly until the first trade. Take me for example. I trade waited on Lumberjanes, and given where the series was after the first trade dropped – issue #12 – I decided to just stick to trade after it. If it had come out between issues #4 and #5, odds are, I’d be buying it monthly now. But that’s me, and each option has its own pros and cons.

That’s because more than ever comics aren’t just one thing or for one type of reader. There are trade waiters. There are strict monthly comic buyers. There are digital readers. There are those who wait for Marvel books to come onto Marvel Unlimited. It’s well past time comics as a whole looks at collections not as replacement products, but as complementary ones (as Sablik spoke to). As options that should be aggressively leveraged on a case-by-case basis, especially for books of a certain type.

We as readers are culpable in collections being viewed this way, though. Omega Men was S.W.O.R.D. once. It was Nextwave. It was She-Hulk. There have been many beloved books that were canceled before their perceived time, and besides Nextwave, most never found the audience they may have deserved in trade. The optics of that are clear for comic publishers: our lust for the survival of pet books has a lot of bark, but very little bite. As archaic as some may view the comic industry’s sales system, it’s all we have. Do you want publishers to take niche titles, particularly the importance of trades for them, more seriously? Then pre-order Omega Men Vol. 1 and talk the book up at your shop. It’s the only way we as readers can impact sales and show that we’re greater than the sum of our tweets.

* Of course, if you’re thinking outside the box, maybe Omega Men should have been a series of two graphic novels to begin with. That’s a story for another article, though.

Data taken from a variety of sources – publisher websites, Diamond and Comichron, mostly – and formulated by yours truly.