Let’s Get Physical: Amazon Books and the Potential Impact of its New Shop on the Direct Market

Recently, there was a great disturbance in the world of brick-and-mortar bookstores. You see, Amazon joined the fray, opening their first actual storefront in the University Village area of Seattle. It’s called Amazon Books, and it has been referred to as the most written about bookstore launch ever. Most of the articles are built around a simple question: why did they do it?

It’s a fair question. Amazon has always been a web-based business. Their dot com site has been the basis of their entire existence since its launch over 21 years ago, and that identity as a more affordable, convenient alternative to physical bookstores has driven its success and quickened the collapse of other booksellers like Borders. To get into the brick-and-mortar side of the game after all these years felt either like a cruel joke or the business equivalent of a Jose Bautista bat flip.

Theories as to the “why” behind this launch ran the gamut, really. Rob Salkowitz at Forbes wondered if it was less a bookstore and more of a “proof of concept” for a hyper-personalized retail experience that merges the physical and digital spaces into one cohesive and collaborative option, and one they could eventually sell to others. Matthew Yglesias at Vox, on the other hand, views the store as a same-day delivery depot that “can also serve as showrooms for Amazon hardware and also help get traditional brick-and-mortar shoppers into the Amazon lifestyle.”

Those disparate takes are just the tip of the iceberg. One of the most surprising takeaways so far has been this, though: it’s just an okay bookstore. Dustin Kurtz at New Republic described it as “aggressively inoffensive,” and most find it to be a solid if not unspectacular addition to the crowded world of bookstores.

Regardless of its intent or quality, though, its existence is one that brings fear into the hearts of retailers everywhere. It’s not what it is right now that scares business owners; it’s what it could be. A centrally located bookstore in one population center could make money but doesn’t have the reach needed to be a game changer. But if Amazon decides to grow this aspect of their business? That’s a completely different story. And Jennifer Cast, the VP of Amazon Books, told Publisher’s Weekly that she is “very, very hopeful” that this is just the first of many locations.

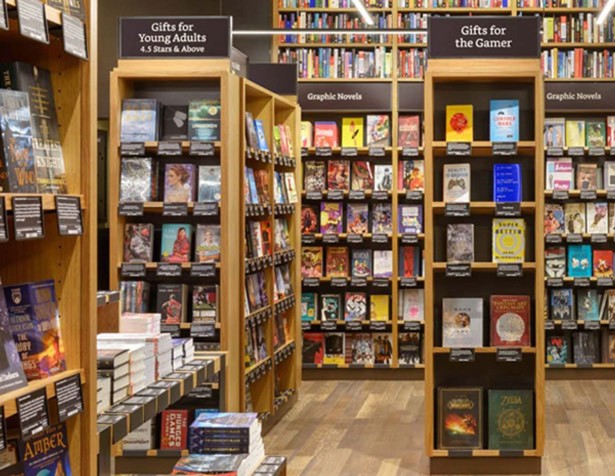

For comic book shops, Amazon already is the great destroyer. While much ado was made about digital comics, even the staunchest of pundits have found them to be additive. Amazon on the other hand? They’re a potential sales replacement, and the growth of the trade and graphic novel market is something Amazon has feasted on. Comic shops can’t compete with the deep discounts the online supergiant offers, and Amazon Books offers the same prices in-store. That’s huge. An Amazon bookstore is, in many ways, the physical manifestation of many comic shops’ worst nightmare.

That’s the story for Ed Sherman, who owns Rising Sun Comics in San Diego. He shared that he’s nervous about the potential impact an expanding physical presence for Amazon could have on his business. And it all comes down to price, as it does for potential customers.

“I was working my store and noticed a male customer checking out the Walking Dead Compendium Volume 3. He asked me if the price was what was printed on the book and I answered yes. He thanked me and left the store without making a purchase,” Sherman said. “Later that afternoon he came back and actually purchased the Compendium. For some reason he informed me that he thought that he could have saved $30 by purchasing it online at Barnes and Noble and picking it up at the local store but they do not work that way. He added that since he wanted it that day he would get it from me because he wanted to support a local small business if he was going to pay full price.”

“It just goes to show you that even for people who want to support their local comic store, the temptation of Amazon-level pricing will overpower their will to do the right thing for their local community,” he added. “If an Amazon store was here I would have lost that sale for sure.”

That’s a legitimate concern, as nothing drives consumer behavior more than price. People want the most affordable option, and it’s no different for comic books and graphic novels. It’s part of the reason some readers are switching to trades these days: it’s a more cost-effective model that also delivers a (more) complete story.

Having heard from Sherman, I was curious as to what the feeling was in the Seattle market. Were local comic book shops in the area feeling the same level of concern, or did they look at it as much ado about nothing? It’s more of the latter, at least in the minds of those I spoke to.

“Amazon has been our greatest competition on graphic novels for a few years for now,” shared Scott Tomlin, the owner of Comics Dungeon, a comic shop that’s only a ten-minute drive from the new Amazon shop. “I don’t think the new store will be a significant impact to us on this front.”

Perry Plush, the owner of Zanadu Comics in Seattle, is uncertain as to the impact the shop might have – “(it’s) too early to tell but we have been dealing with this for many years” – but he thinks the sensibilities of Seattle consumers (including Amazon employees themselves) and the nature of comic shops will help ensure that they will be just fine.

“Seattle has a love/hate feeling about Amazon. Everybody uses them but I think a lot of customers try to shop local. We once had Amazon offices in a building across the street from our downtown store. We still sold employees plenty of comics,” he said. “I feel that book and comic buyers go where the best selection, knowledge and atmosphere. That is what we strive for.”

Tomlin agrees with that idea. He expects the impact to his shop to be limited overall. That’s partly due to Amazon’s limited in-store selection (which, according to ICv2, is mostly just the first and last collections of a series), but also because of the experience he can promise customers. That, he believes, will help differentiate shops like his into the future.

“We pride ourselves on knowledge, customer service and the safe environment we provide. We have made parallels between LCS and Taverns, where your bartender is focused on making your experience great with the personal touch that one-on-one service brings,” he said. “Do you think kids will lay on the floor of Amazon and thumb through their favorite comic? They do at our place. Do you think the Amazon employee will know the story arc where Superman kills Zod in a pocket universe? They do at our place.”

“Service and environment is what differentiates comics shops today and is what will differentiate us from Amazon going forward.”

Salkowitz – an author that has long written about comics at the intersection of business and technology – believes both sellers are correct in their belief that Amazon’s not going to be a major threat.

“I don’t think they are competing with comic stores directly at all,” Salkowitz said, citing their very limited selection as the main reason. “Most people I know go to comic stores for the atmosphere and the camaraderie of the staff, which is not really a factor at a sterile, mall bookstore like Amazon.”

“Amazon’s online store remains the biggest direct competition to brick and mortar, whether general bookstores or comic shops.”

The Amazon shop doesn’t threaten comic shops too directly due to one key component that is missing: actual comics. While they do carry a bevy of the more popular trades and graphic novels, they are like most bookstores and lack comics in their inventory. It’s doubtful they ever will ever expand in that direction. But if shops lost a part of their collections business, they’d feel it, especially with how significant the trade and graphic novel audience is these days. At Tomlin’s shop, trades and graphic novels are 40% of his business and holding steady, but that wasn’t always the case.

“Five years ago however it was over 50%,” he said. “This was about the time that Amazon really started to stock and discount these items.”

Plush – whose shop just celebrated its 40th anniversary – finds that his trade and graphic novel audience (which totals about 30% of his customer base) is the gateway to the world of floppy comics. That’s huge for them.

“I see new customers starting out reading and buying new graphic novels to get more of the whole story then working into comics.”

That’s part of the reason he doesn’t fear Amazon’s new shop. He views bookstores as “feeder(s) to my store and comic shops.” He’s hopeful that readers will get hooked on trades or graphic novels they discover at the Amazon shop, and from there will become customers at his store.

That section of the business is enormously valuable outside of their potential as a gateway to the medium, though. Trade and graphic novel readership is growing, and these often more casual readers are part of why collections and graphic novels have been one of the biggest drivers of the industry’s growth in recent years. Amazon’s focused on that section of the business entirely, and doing so with a cherry picked selection in-store. There’s a very good reason for that.

One of the prevailing theories of the purpose of the Amazon store is it’s a discovery point that will help their online and digital stores. A place where readers can find new stories to invest in, like The Walking Dead customer Sherman spoke of earlier. That ties in with why Amazon’s only stocking the first and last volumes of each series they inventory at the store. Sherman knows this is a calculated business decision, as he’s seen that kind of consumer behavior in his own shop.

“I spend my life analyzing my POS data trying to identify and predict customer’s buying trends,” Sherman said. “The very first volume and the latest volume are the overwhelming majority of sales, especially when a series is a long one. The volumes in the middle very rarely sell. That is exactly why Amazon is stocking their store the way they are. They get it. They actually know what sells and what doesn’t.”

Amazon’s a smart business, and of course they’re going to leverage the data at hand to drive sales and revenue growth. They’d be fools not to. Will the way they use data to stock their comics increase the competition to the direct market? Maybe. Or maybe not. Much of it depends on Amazon’s next steps. As of right now, there aren’t even plans for expansion of their physical footprint, and to really make a dent with these shops, they’d need a lot more locations. Salkowitz, for one, would be surprised to see Amazon go down that path.

“There’s no real reason for them to do that, beyond creating a proof-of-concept,” he said, before adding, “But then again, Amazon does a lot of stuff for no discernible market reason, so anything is possible.”

Amazon is, for many, the devourer of worlds when it comes to the print industry. It’s natural for shop owners like Sherman to be concerned as to what the potential impact could be. But so far, the Seattle shops I spoke to haven’t felt anything discernible yet, nor do they expect to in any significant way. That’s a good thing.

As of now, any thoughts on the potential impact of Amazon’s first physical store are guesswork, especially given how little they’ve revealed about their plans. My Magic 8-Ball’s firmly set on “Ask again later,” as only time will tell how Amazon’s latest and perhaps most unexpected venture yet will impact comic shops. But it’s something worth paying attention to going forward, both in terms of what Amazon’s next move is and how it affects Seattle’s comic community in the near future.

Header image from Adafruit’s article on the Amazon shop. Thanks to Perry Plush, Rob Salkowitz, Ed Sherman and Scott Tomlin for the insight for this piece.